sukuk malaysia 2016

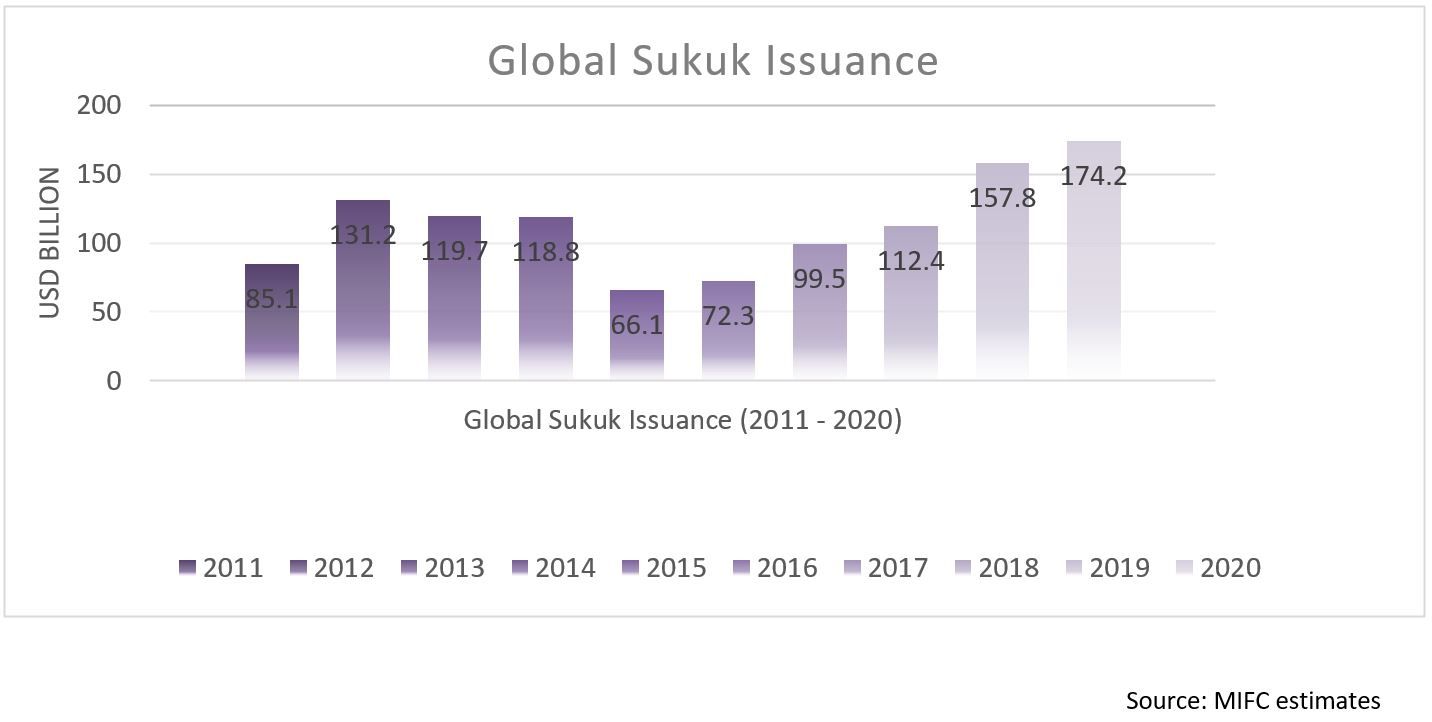

Global sukuk outstanding increased to a record of USD3491 billion as of December 2016 an 87 increase from USD3212 billion as at end-2015. Value of corporate sukuk new issuances Malaysia 2016-2020 Average gross monthly yields on treasury bonds BTPs in Italy 2016-2021 US.

What S Fueling The Sukuk Issuance In 2016 The Asset

By domicile Malaysias secondary sukuk market stood at USD1838 billion representing a share of 526 of There was a notable shift in composition of sukuk issuers in 2016.

. In its Annual Report 2016 released yesterday the SC said the Islamic capital market ICM accounted for 5956 of Malaysias capital market. Fitch Ratings has assigned Malaysias proposed US dollar-denominated sovereign global sukuk trust certificates to be issued by Malaysia Sukuk Global Berhad MSGB an expected A-EXP rating. SBNMI are based on al-ijarah sale and lease back principle.

Try our corporate solution for free. Developments in the SRI arena have catalysed the exponential growth of ASEAN sustainable bonds and sukuk. Today Malaysias Islamic banking assets amount to 656 billion and the industry sees a robust average growth rate of around 18-20 annually.

The RM3 billion sukuk which has a 3-year tenure offers a return of 5 per annum. Skip to main content. The sukuk value represented 452 of the total new corporate bonds and sukuk approved and lodged with the Securities Commission Malaysia SC of 56 amounting to RM14099 billion in 2016.

Sukuk Bank Negara Malaysia Issues SBNMI are zero-coupon bonds with maturities of 12 years. The sukuk which will be scripless and based on Shariah principles is an additional investment instrument for Malaysian citizens who are 21 years and above. In order to further spur the development of Islamic finance in February 2016 Malaysia developed the marketplaceIF which provides access to the global community seeking financial.

The repayment of any fixed-income bonds andor sukuk also called redemption in Malaysia reached a record of 30035 billion Malaysian ringgit in 2019. Fitch Assigns Malaysias Sukuk A- EXP Mon 11 Apr 2016 - 320 AM ET Fitch Ratings-Hong Kong-11 April 2016. The role of Bank Negara Malaysia BNM the countrys central bank has been crucial in establishing the right regulatory framework and creating an environment where the Islamic financial industry.

Bank Negara Malaysia has been appointed to issue the sukuk on behalf of the Government. Property-casualty insurance company corporate foreign bond. Between 2016 to 2020 the ASEAN6 markets saw significant increases at 198 CAGR in sustainable bonds and sukuk issuance for financing growth aligned with ESG principles with an issuance value estimated to have reached US298billion as of.

The Global Islamic Finance Market Part 1 Sukuk Bonds Islamic Finance Worldwide

The Importance Of The Malaysian Sukuk Comparing With Other Countries Download Scientific Diagram

Sukuk An Asset Class Goes Mainstream Franklin Templeton

Sukuk Market Overall Statistics Download Scientific Diagram

Sukuk Growth And Distribution Download Scientific Diagram

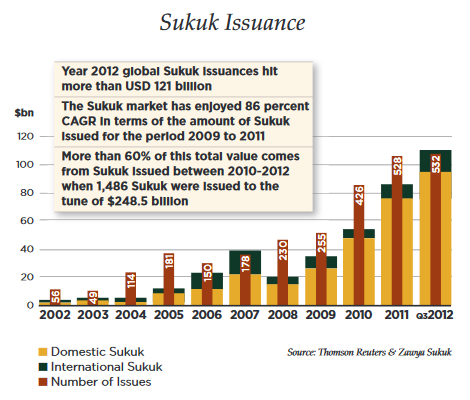

Pdf On The Potential Growth Of Sukuk Issues And Its Challenges Semantic Scholar

Why Green Sukuk Could Be A Growth Driver For Islamic Finance By Bashar Al Natoor Why Forum Medium

Record Saudi Sukuk Broadens Market Global Finance Magazine

Sukuk Market By Country Of Obligor Download Scientific Diagram

A Joint Publication On Sukuk Market Snapshot By Inceif And Ram Ratings Inceif

Pdf On The Potential Growth Of Sukuk Issues And Its Challenges Semantic Scholar

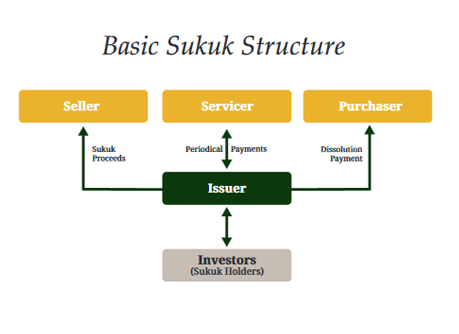

What Are Sukuk Azzad Asset Management Halal Investment

Malaysia New Issuance Bonds And Sukuk 2020 Statista

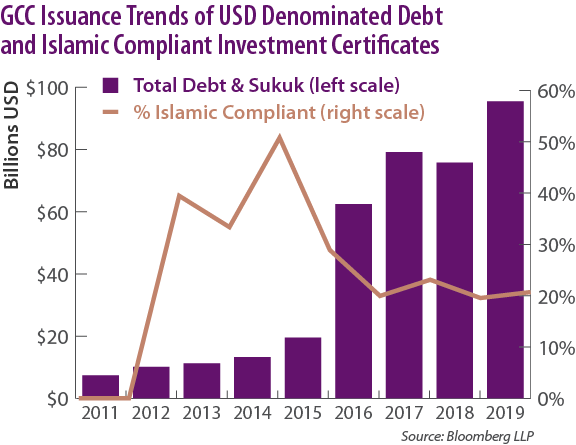

Gcc Sukuk A Primer Saturna Capital

What Are Sukuk Azzad Asset Management Halal Investment

What Are Sukuk Azzad Asset Management Halal Investment

Pdf On The Potential Growth Of Sukuk Issues And Its Challenges Semantic Scholar

Sukuk Market Global Industry Trends Share Size Growth Opportunity And Forecast 2022 2027

No comments for "sukuk malaysia 2016"

Post a Comment